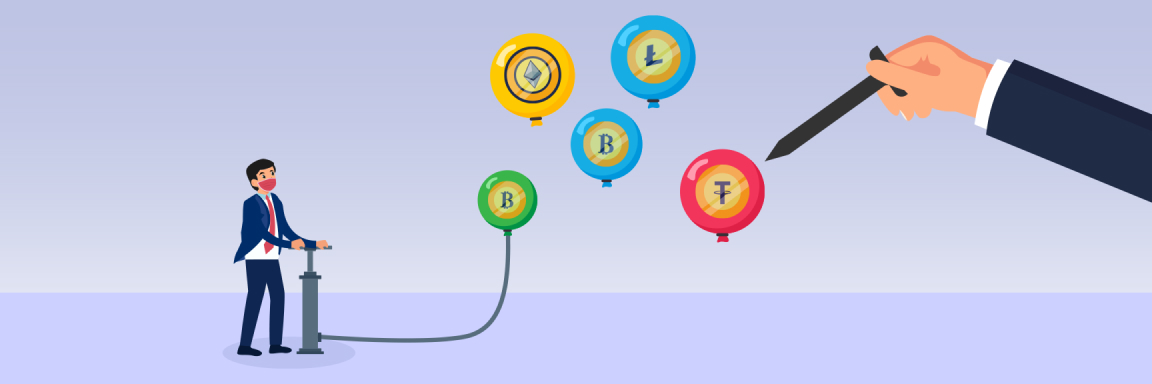

One of the most common types of stock market scams is known as a pump-and-dump scam. These scams typically target small- and micro-cap stocks, also known as penny stocks. If you’re considering investing in penny stocks, you definitely need to be aware of this prevalent scam and know how to avoid becoming the next victim of one.

.png)

What Is a Pump-and-Dump Scam?

A pump-and-dump scheme is when fraudsters artificially inflate (pump) the prices of stocks or securities, usually through false or exaggerated statements that lead investors to believe the assets are a better investment than they really are.

These scams are often run by fraudulent stock brokers and stock promoters, but anyone with access to a trading account is capable of operating a pump-and-dump stock scam.

How Does a Pump-and-Dump Scheme Work?

Scammers often use high-pressure sales tactics, including boiler room cold-contacting, to push unsuspecting investors into buying large quantities of the stocks they want to increase the value of. They also typically release misleading information, such as fake press releases, about the success of a company in order to convince investors to buy shares in it.

In some cases, the companies pump-and-dump scammers promote are total shells, and aren’t conducting real business of any kind.

Once the price of the shares involved in one of these schemes reaches a certain threshold, the scammers immediately sell off (dump) all the assets they hold at a large profit. This results in the prices of the shares immediately plummeting, and all the other investors who weren’t in on the scheme lose on their trades.

How Is Pump-and-Dump Illegal?

The Securities Exchange Act of 1934 prohibits any fraud, material misstatements, or material omissions in connection with the purchase or sale of securities. Anyone found to be part of a pump-and-dump scheme is in violation of this act, and can also be found in violation of a number of other laws. Those charged and found guilty of these shady business practices face heavy fines and even jail time.

Two Famous Pump-and-Dump Stories

1. The Wolf of Wall Street: The Most Infamous Pump-and-Dump Scam Ever

.png)

If you’ve seen the Hollywood movie The Wolf of Wall Street, you already know the story of one of history’s most famous pump-and-dump stock market scams.

The movie is based on the memoir (of the same title) of Jordan Belfort, a former Wall Street stockbroker who was convicted of securities fraud in the late 90s. This resulted from the fact that Belfort and his firm, Stratton Oakmont, were operating a pump-and-dump boiler room to market penny stocks and inflate their values before selling off their own shares, ultimately defrauding investors of at least $200 million.

Belfort was caught and eventually spent 22 months in jail and was ordered to pay back approximately $110 million to investors.

2. An International Pump-and-Dump Scheme in 2022

In April of 2022, the Securities and Exchange Commission (SEC) announced charges against 16 defendants, who were operating a penny stock pump-and-dump scam for years across multiple countries, including the Bahamas, the British Virgin Islands, Bulgaria, Canada, the Cayman Islands, Monaco, Spain, Turkey, and the United Kingdom. The international crime ring allegedly stole at least $194 million from investors through their complex penny stock scam.

Though these perpetrators got caught, there are many such rings that continue to operate in complex offshore networks to evade the authorities. But, as it turns out, no pump-and-dump scammers are safe forever.

How To Avoid Pump-and-Dump Scams

Think Twice Before Investing Anywhere

Any investment is a risky commitment, so you should be 200% sure about where you put your money. Making impulsive investment decisions without doing your research or based on emotions or a fear of missing out is the best way to get scammed through a pump-and-dump scheme.

Remember that fraudulent stock promoters and brokers usually use high-pressure sales tactics to get you to buy penny stocks without thinking or taking the time to investigate them yourself. If you take the time to think twice before any investment, you’re much less likely to fall victim to an investment scam.

Assume Everything You Read Is False Online Unless Proven Otherwise

Since scammers release fake statements and post articles with false information online as part of their strategy to inflate stock prices, you have to be very careful about where you get your information.

Securities criminals have gotten very good at making their sites look professional and believable. So, just because something looks and sounds legit, doesn’t mean it is.

To avoid pump-and-dump stock schemes, always get your investment advice from trusted online sources or reputable brokers. Some reliable online sources of information include:

-

Yahoo! Finance

-

Investopedia

-

The Motley Fool

-

NerdWallet

Do Your Own Research on the Stock

Always, and we mean ALWAYS, do your own research before you buy a stock. If you read or hear something about a particular company, especially if it’s from an unsolicited source, always fact check the information on reputable sites or with a broker or investment advisor you trust.

The financial information for public companies is also fairly easy to obtain, so you can independently verify things like statements about quarterly earnings for specific companies you are thinking about investing in.

You can also Google the name of a stock or a broker who is trying to sell it to you, followed by keywords like “scam” or “fraud,” in order to see if there is any recent information about shady business practices revolving around them.

Check Whether the Stock Promoter Is Part of a Regulated Brokerage

Whenever you’re considered buying stocks through a certain broker, first verify that they are properly licensed and regulated in your area.

Remember that many scammers operate offshores to protect themselves from local governing bodies, and thus they aren’t part of a regulated brokerage. You should always be able to independently verify the licensing and registration status of any broker you’re going to work with.

You should also check if the broker is already flagged for fraudulent activity on a blacklist of fake broker’s, such as the Top 10 Chargeback blacklist.

“Too-Good-To-Be-True” Investments Usually Are Exactly That

The golden rule for avoiding any type of investment scam is that if it sounds too good to be true, it probably is.

The reality is that any type of stock market investing, especially investing in penny stocks, takes time to make good returns on.

For example, most day traders spend time every day for years buying and selling stocks before they actually make large, consistent profits. More casual investors usually need to hold onto stocks for years before they make even a 10% return on their investments.

So, if someone approaches you and tries to sell you on buying a bunch of stocks to “get rich quick,” it’s best to walk the other way.

Where To Go if You Are a Victim of a Pump-and-Dump Scam

Even if you know how pump-and-dump scams work and are aware of the red flags and how to avoid them, you can still fall victim to one of these schemes.

In the unfortunate event that you lose your hard-earned funds to scammers, you may still be able to get it back with the help of the fund recovery experts at one of the chargeback companies listed and reviewed on Top 10 Chargeback.

If you suspect you were hit by a pump-and-dump scam, contact a chargeback company today for the highest odds of getting some or all of your money back.